A Failure of Capitalism: 1970 – 2009

© 2009 by Jack Lessinger and Ranger Kidwell-Ross

Jack Lessinger is an Emeritus Professor, University of Washington, and CEO of SocioEconomics, Inc.

Ranger Kidwell-Ross is a graduate economist and President of SocioEconomics, Inc.

Capitalism relies on prices to guide production and consumption. But unregulated home prices rose far too high and are now rocking the economy with unwarranted investments. To restore the supply of credit, federal deficits may top more than ten trillion. Objective signs of unwarranted price rises could have been detected. In carefully delineated markets, government should have restrained the rise by raising mortgage interest rates.

California, epicenter of suburbia, is the epicenter of the housing boom and bust. And Los Angeles County is at the very center of the epicenter. From 1945 to 1970, the rising middle-class, poured into suburban Los Angeles. Since as early as 1970, however, middle-class families have been clearing out, their thinning ranks often replaced by poorly-paid immigrants crowding into those expensive homes two or more families at a time. In 2006, Hispanics alone made up 46.8 percent of Los Angeles County’s total population.

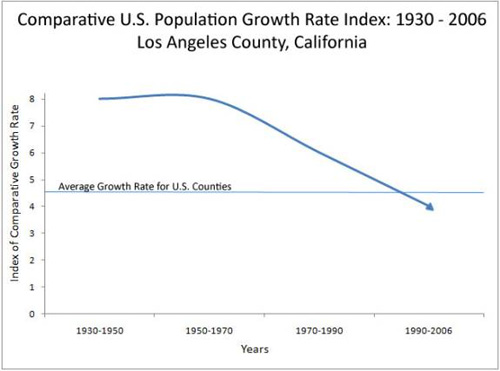

Selling at wildly inflated prices, savvy suburbanites found better and cheaper houses elsewhere, thus exporting housing booms from suburbia to the rest of the nation. Los Angeles County was among the first to attract new migrants after World War II. The following chart shows changes in the rank of Los Angeles County among U.S. counties. (An index of “8” indicates the fastest growing counties and “1” the slowest.) Los Angeles remained at “8” from 1930 to 1970. After 1970 began a long and consistent downturn. By 2006, Los Angeles County’s growth rate had fallen to an unimaginable tad below the national average!*

[Source : NBER, Census Data]

Rank of Los Angeles County Among all U.S. Counties

Why did Los Angeles growth rates decline after 1970? Except for the two world wars, the 1960s had experienced the 20th century’s peak acceleration of GDP. That decade of crowning consumerism had filled the available land supply with legions of subdivisions, shopping centers and parking lots. Not only were real-estate values continually rising, but the conquest of suburbia industriously wrecked the very charms that first enticed that great land rush. Suburbanites became disenchanted with armadas of automobiles, polluted air and lengthened commutes—and with the never-ending rise in home values. The demand for suburban homes by the middle class had begun a long decline.

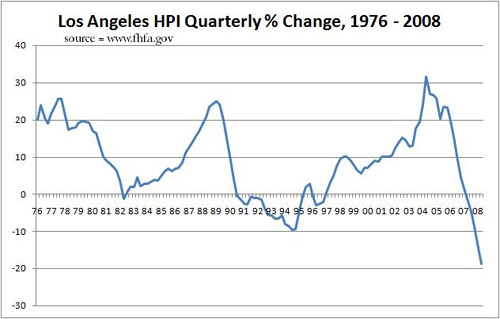

According to the two-century old doctrines of economic “science,” home prices should guide the economy in directing investments to other regions. Unfortunately, the large percentage increases from 1995-2005 were contraindicated by the obvious facts of declining demand.

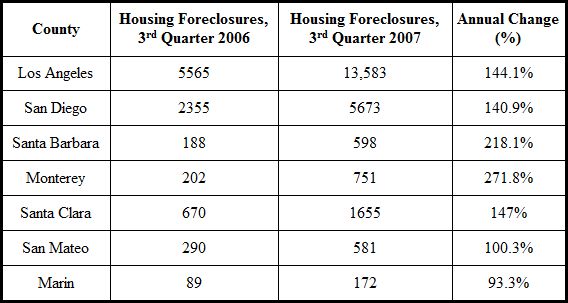

Like Los Angeles County, many other counties of coastal California experienced a decline in growth rate rankings. Similarly, Florida is another state with coastal counties growing rapidly during the period of suburbanization 1945-1970. It is no surprise that, in recent years, both states have experienced far more housing foreclosures than the nation as a whole. In the year ending February, 2007, nation-wide foreclosures increased by 11.64 %, but Florida’s increased by 91.08 % and California’s by 78.63%. (Source: Money, CNN.com) Later statistics show a pronounced rise in seven coastal counties of California.

Recent Housing Foreclosures for Seven California Coastal Counties

[Source : NBER, Census Data]

Enter a cocksure and bumptious delusion, that Los Angeles and all the rest of the suburban paradise would keep rising in value. It seemed inevitable. Wasn’t the supply of land limited? Not at all. And, as ‘We the People’ discard the preferences of the ‘Little King,’ consumer-based paradigm and move to the next geographical area of interest to the rising ‘Responsible Capitalism’ socio-economy, real estate demand will change accordingly.

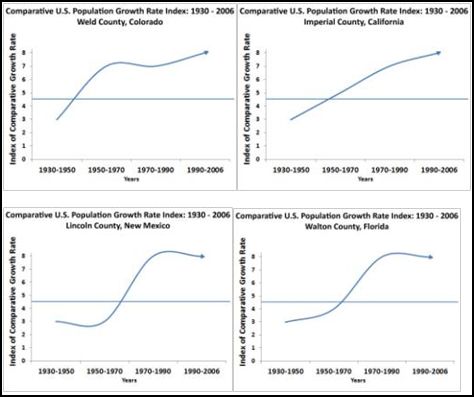

To keep land values strong in these formerly attractive areas would only be an attempt to rehabilitate a dying past. However, the horizon is far from bleak. Whole counties in our midst are vividly alive today—and there are many of them—every one uniquely suited to the tastes and preferences beckoning all of us to green and responsible life in the 21st century. Dr. Lessinger’s book “YOUR COUNTY, BOOM OR BUST?,” last updated in 2008, identifies counties across the nation with rapidly increasing rates of comparative growth. A few are shown below.

The present housing bust is a large impediment to our hopes for a rising GDP to occur soon. Suburban home prices will continue to decline. As we have seen so vividly, the stock market cannot remain immune—nor the banks with their presumably secure investments. Quick fixes that cheered us so readily in the past—lowering the interest rates, inter-bank loans, government subsidies and bail-outs—now seem tinged with irrelevance. They are. As we move into a new “What’s in it for Us?” socio-economy that emphasizes global greenness and the greater good — and where consumption isn’t the most important factor ruling everyone’s lives, an entirely different set of ‘economic stimuli’ will be required.

This article may be reprinted in its entirety as long as the following paragraph is left intact. As a courtesy, please notify upon usage by sending an email to info@socio-economics.com.

Jack Lessinger is Chief Operating Officer of SocioEconomics, Inc., and the father of the Theory of Socio-Economics. For more information, including links to books as well as free audios, videos and other articles on this and related topics, go to www.socio-economics.com. Dr. Lessinger may also be reached via email sent to jack@socio-economics.com.